Value added courses

- INTRODUCATION

- ADVANCE EXCEL

- DIGITAL MARKETING (BASICS)

- DIGITAL MARKETING (ADVANCED)

- FINANCIAL LITERACY

- NISM - MUTUAL FUND

- NISM - DERIVATIVE MODULE

INTRODUCTION

In the current era of transformation in Indian economy from manual to digital, from paper to paper less, from contact to contact less along with technology-based infrastructure, there is a massive requirement of trained graduates and professionals equipped with domain specific skill set. To cater this need, Tecnia Institute of Advanced Studies (TIAS) has introduced various value-added programmes across all the professional courses running under GGS Indraprastha University, Delhi. The value-added Programmes for MBA are strategically planned for the holistic development of learners. The courses have been aimed to create a platform for students to explore and realize their potential to the fullest capacity. For MBA Key NISM Modules have been introduced to enhance employability.About NISM

- NISM stands for National Institute of Securities Market and is awarded by NISM – An education wing of SEBI, India.

- There are different modules for different segments of financial market.

- For MBA’s, Financial Market Module, Capital Market module, Equity derivative market module and Mutual Fund Modules are important from employment point of view.

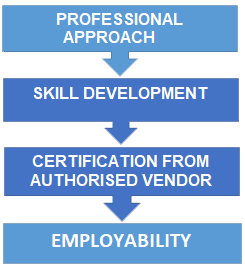

PROCESS FLOW CHART

| DMS-VAC-01 | ADVANCE EXCEL | Credits:2 |

Pre-Requisites​​

- Basic understanding of MS excel shall be added advantage.

Objectives​​

The objective of this course is to provide conceptual and Practical understanding of Excel and how to set up the chart function of Excel to represent numeric data in multiple formats. The course helps to understand Differentiate between formulas and functions in Excel. It helps to Access and manipulate data using the database functions of Excel. • Create simple & complex macros in Excel.

Learning Outcomes​​

At the end of the course, the students will be able to:

- Apply advanced formulas to lay data in readiness for analysis.

- Use advanced techniques for report visualizations.

- Leverage on various methodologies of summarizing data.

- Understand and apply basic principles of laying out Excel models for decision making.

Detail Contents

|

List of Suggested Books

- Microsoft Excel 2019 Bible: The Comprehensive Tutorial Resource.

- Excel 2019 ALL-IN-ONE for Dummies.

- Excel: Quickstart Guide from Beginner to Expert.

- Excel 2019: Pivot Table Data Crunching.

| DMS-VAC-02 | DIGITAL MARKETING | Credits:4 |

Pre-Requisites​​

- Students should have knowledge of online marketing fundamentals and advertising via online media such as print, digital, internet marketing

Objectives​​

The main objective of this course to make participants understand the online business models and digital marketing methodology from the point of view of consumers, entrepreneurs. Moreover, the course aims at understanding the student’s different techniques of digital marketing so that they can utilize this technique to support organization’s marketing activities

Learning Outcomes​​

On successful completion of the course, the students will be able to:

- Different techniques of promotion on online platforms

- Internet marketing communication techniques

- Interpret the traditional marketing mix within the context of a changing and extended range of digital strategies and tactics.

- Comprehend the importance of conversion and working with digital relationship marketing

GGSIPU UNIVERSITY syllabus​​

Detail Contents

|

List of Suggested Books​​

- 1. Chaffey, D, Ellis-Chadwick, F, Johnston, K. and Mayer, R, (4th Ed.,2009) Internet Marketing: Strategy, Implementation and Practice, Third Edition, Pearson Education, New Delhi.

- Strauss, Judy and Frost, Raymond (6th Ed, 2011), E-Marketing, 5th Edition, PHI Learning, New Delhi.

- Roberts, M, L,.(3rd Ed, 2013) Internet Marketing, 1st Indian Edition, Cengage Learning, New Delhi

- Shainash G, and Jagdish N Sheth (1st Ed, 2008). Customer Relationship Management- A Strategic Perspective, Macmillan India Ltd

| DMS-VAC-02 | DIGITAL MARKETING | Credits:4 |

Pre-Requisites​​

- Students should qualify basic level of digital marketing and must have the knowledge of marketing platforms for advertising via online media such as print, digital, internet marketing

Objectives​​

The main objective of this course is to make goals, plan campaigns, and reach customers. Understand what keeps customers engaged between attention and action Modify current business operations to provide a better online experience. Master the science of measuring performance versus plan. Grasp the Project management skills. Know how to continuously improve performance to increase ROI with data and analytics.to support organization’s marketing activities.

LEARNING Outcomes

On successful completion of the course, the students will be able to:

- Know different techniques of SEO

- Understand the target audience by using different tools

- Hands-on experience on different promotional techniques.

- Learn advanced promotional techniques by using different online marketing tools and channels.

GGSIPU UNIVERSITY syllabus​​

Detail Contents

|

List of Suggested Books​​

- The psychology of email marketing Influencing subscribers and driving engagement Author: Eleanor Blake Year: 2023

- Strauss, Judy and Frost, Raymond (6th Ed, 2011), E-Marketing, 5th Edition, PHI Learning, New Delhi.

- Chaffey, D, Ellis-Chadwick, F, Johnston, K. and Mayer, R, (4th Ed.,2009) Internet Marketing: Strategy, Implementation and Practice, Third Edition, Pearson Education, New Delhi.

- Shainash G, and Jagdish N Sheth (1st Ed, 2008). Customer Relationship Management- A Strategic Perspective, Macmillan India Ltd.

- The Art Of SEO: Mastering Search Engine Optimization by Eric Enge of Stone Temple Consulting, Stephan Spencer, and Jessie C. Stricchiola.

| DMS-VAC-03 | FINANCIAL LITERACY | Credits:2 |

Pre-Requisites

- Awareness about basic accounting terms.

- Basic mathematical aptitude

- Exposure about Financial News

Objectives

The objective lays a foundation for learners to build strong money habits early on and avoid many of the mistakes that lead to lifelong money struggles.

Learning Outcomes

- To be able to understand external factors affecting financial decisions

- To be able to calcolate money management with accuracy

- To understand financial appraisal tools

- To be able to understand financial Market

- To be able to understand popolar and safe investment avenues available in the market.

Course Content

|

LIST OF SUGGESTED BOOKS

- The legacy of financial literacy: guiding my child to financial success by jyotinath ganguly

- Economic environment in india by Dr. Ravindra Kumar

- Financial Mathematics: a comprehensive treatment by giuseppe campolieti, Roman N. Makarov

WEBSITES FOR REFERENCE

| DMS-VAC-04 | NISM – MUTUAL FUND | Credits:2 |

Pre-Requisites

- Awareness about basic financial terms.

- Awareness about Financial Products

- Exposure about Financial market

Objectives

The Objective of this course was having operational and conceptual knowledge of Mutual Fund to become employable in the organizations dealing in Mutual Fund segment, Also to crack NISM – Mutual Fund distributors Module exam organised by SEBI-NISM

About NISM

- NISM stands for National Institute of Securities Market and is awarded by NISM – An education wing of SEBI, India.

- There are different modules for different segments of financial market.

- For MBA’s, Financial Market Module, Capital Market module, Equity derivative market module and Mutual Fund Modules are important from employment point of view.

Learning Outcomes

- Have conceptual framework – functional, legal, and organisational aspect of Mutual Fund.

- By Passing NISM Mutual Fund Module students can become SEBI approved (Valid ARN) Mutual Fund Advisor.

- Become employable in Banking sector, broking houses etc

Course Structure

|

LIST OFSUGGESTED BOOKS

- Study Material prepared by NISM for NISM – Mutual Fund Module

WEBSITES FOR REFERENCE

| DMS-VAC-05 | NISM – DERIVATIVE MODULE | Credits:2 |

Pre-Requisites

- Awareness about basic financial terms.

- Awareness about Financial Products

- Exposure about Financial market

Objectives

The Objective of this course was having operational and conceptual knowledge of Equity Derivatives segment, also to crack NISM – Equity Derivatives Module exam organised by SEBI-NISM

About NISM

- NISM stands for National Institute of Securities Market and is awarded by NISM – An education wing of SEBI, India.

- There are different modules for different segments of financial market.

- For MBA’s, Financial Market Module, Capital Market module, Equity derivative market module and Mutual Fund Modules are important from employment point of view.

Learning Outcomes

From this Course Students

- Have conceptual framework – Functional and Conceptual knowledge of Derivative Market Module.

- By Passing NISM Equity derivative Module students can become dealer for derivative segment

- Become employable in Banking sector, broking houses etc

Course Structure

|

LIST OF SUGGESTED BOOKS

- Study Material prepared by NISM for NISM – Derivative Module