Add-On courses

- INTRODUCATION

- FINANCIAL LITERACY

- NISM - MUTUAL FUND MODULE

- CORPORATE GROOMING

- NISM - DERIVATIVE MODULE

INTRODUCTION

In the current era of transformation in Indian economy from manual to digital, from paper to paper less, from contact to contact less along with technology-based infrastructure, there is a massive requirement of trained graduates and professionals equipped with domain specific skill set. To cater this need, Tecnia Institute of Advanced Studies (TIAS) has introduced various value-added programmes across all the professional courses running under GGS Indraprastha University, Delhi. The value-added Programmes for MBA are strategically planned for the holistic development of learners. The courses have been aimed to create a platform for students to explore and realize their potential to the fullest capacity. For MBA Key NISM Modules have been introduced to enhance employability.About NISM

- NISM stands for National Institute of Securities Market and is awarded by NISM – An education wing of SEBI, India.

- There are different modules for different segments of financial market.

- For MBA’s, Financial Market Module, Capital Market module, Equity derivative market module and Mutual Fund Modules are important from employment point of view.

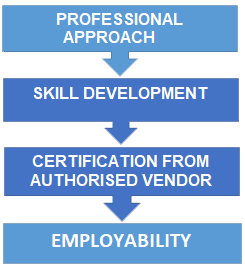

PROCESS FLOW CHART

|

|

FINANCIAL LITERACY | Credits |

| 2 |

Pre-Requisites​​

- Awareness about basic accounting terms.

- Basic mathematical aptitude

- Exposure about Financial News

Objectives​​

The objective lays a foundation for learners to build strong money habits early on and avoid many of the mistakes that lead to lifelong money struggles.

Learning Outcomes​​

- To be able to understand external factors affecting financial decisions

- To be able to calcolate money management with accuracy

- To understand financial appraisal tools

- To be able to understand financial Market

- To be able to understand popolar and safe investment avenues available in the market.

Course Content

|

LIST OFSUGGESTED BOOKS​​

- The legacy of financial literacy: guiding my child to financial success by jyotinath ganguly

- Economic environment in india by Dr. Ravindra Kumar

- Financial Mathematics: a comprehensive treatment by giuseppe campolieti, Roman N. Makarov

WEBSITES FOR REFERENCE​​​​

|

|

NISM – MUTUAL FUND MODULE | Credits |

| 2 |

Pre-Requisites​​

- Awareness about basic financial terms.

- Awareness about Financial Products

- Exposure about Financial market

Objectives​​

The Objective of this course was having operational and conceptual knowledge of Mutual Fund to become employable in the organizations dealing in Mutual Fund segment, Also to crack NISM – Mutual Fund distributors Module exam organised by SEBI-NISM

About NISM​​

- NISM stands for National Institute of Securities Market and is awarded by NISM – An education wing of SEBI, India.

- There are different modules for different segments of financial market.

- For MBA’s, Financial Market Module, Capital Market module, Equity derivative market module and Mutual Fund Modules are important from employment point of view.

Learning Outcomes​​

- Have conceptual framework – functional, legal, and organisational aspect of Mutual Fund.

- By Passing NISM Mutual Fund Module students can become SEBI approved (Valid ARN) Mutual Fund Advisor.

- Become employable in Banking sector, broking houses etc

Course Structure

|

LIST OFSUGGESTED BOOKS​​

- Study Material prepared by NISM for NISM – Mutual Fund Module

WEBSITES FOR REFERENCE​​​​

|

|

CORPORATE GROOMING | Credits |

| 2 |

INTRODUCTION

Grooming rules might indicate ways to start and end conversations, dress-up for different occasions, introduce guests to others, dining manners, and so on. The person who can engage in conversation and get along with others in ways that construct trust and respect will certainly win people and business deals. Statistics show us that an individual determines whether they like or trust you within the first seven seconds of your meeting with them. 60% is established based on appearance, 30% is centred on the tone of your voice, and 10% on your actual business. This tells us that 90% of your Professional Business and Corporate grooming can massively affect your business dealings with your co-workers or your business partners and clients. Your first impression cannot be created at a second chance. You have to get it right for the first time. Through this Corporate Grooming program, you will be enabled to recognize and sharpen those corporate skills. You will know how to carry yourself confidently and in a correct professional manner in the business world and in your day to day personal life at all times. This course gives you the skills to have leverage on career opportunities and personal growth. You will be noticed and recognized for professionalism by the skills learned through this program.

Pre-Requisites​​

- Basic communication skills

- Basic understanding of corporate environment shall be added advantage

Objectives​​

The core objectives of this Corporate Etiquette Training Course is to enable you to —

- Set the best impression by your professional corporate skills

- Understand Body language and the influence of it

- Sharpen your office skills including telephonic, letter and email communications

- Learn details of business dining skills and mannerisms

- Understand dress codes for different occasions

Learning Outcomes​​

- Better inter-personal skills

- Help gain mannerisms that could align with the corporate culture and values

- It enhances healthy relationships and understanding

- Enhanced non-verbal communication within the corporate set-up

- Professionals become more confident with communicating and networking

- Inter-personal skills are sharpened and developed to build class and excellence

- Individuals become more efficient in handling and communicating with other

- Self-Confidence and positive energy become evident by the mannerisms

- Better able to manage time effectively

Course Structure

|

LIST OF SUGGESTED BOOKS​​

- Bindra V. Everything About Corporate Etiquette. Bloomsbury, 2015.

- Gulati S., Corporate Grooming and Etiquette. Rupa Publications India, 2010

- Axelrod A., My First Book of Business Etiquette, Quirk Books, 2004

- Kay Dupont M., Business Etiquette and Professionalism, Crisp Learning, 2000

- Stephen Robbins and Timothy Judge., Essentials of Organizational Behavior, Pearson Education, 2012

- Anthony Gutierez., Effective Communication in the Workplace

|

|

NISM – DERIVATIVE MODULE | Credits |

| 2 |

Pre-Requisites​​

- Awareness about basic financial terms.

- Awareness about Financial Products

- Exposure about Financial market

Objectives​​

The Objective of this course was having operational and conceptual knowledge of Equity Derivatives segment, also to crack NISM – Equity Derivatives Module exam organised by SEBI-NISM

About NISM​​

- NISM stands for National Institute of Securities Market and is awarded by NISM – An education wing of SEBI, India.

- There are different modules for different segments of financial market.

- For MBA’s, Financial Market Module, Capital Market module, Equity derivative market module and Mutual Fund Modules are important from employment point of view.

Learning Outcomes​​

From this Course Students

- Have conceptual framework – Functional and Conceptual knowledge of Derivative Market Module.

- By Passing NISM Equity derivative Module students can become dealer for derivative segment

- Become employable in Banking sector, broking houses etc

Course Structure

|

LIST OF SUGGESTED BOOKS​​

- Study Material prepared by NISM for NISM – Derivative Module